With the implementation of the Affordable Care Act, individuals that meet eligibility are required to carry health insurance. Each state has a marketplace in which individuals can enroll to see if they are eligible for a health insurance plan.

With the implementation of the Affordable Care Act, individuals that meet eligibility are required to carry health insurance. Each state has a marketplace in which individuals can enroll to see if they are eligible for a health insurance plan.

Kootenai Health’s Social Services department can help anyone who wants assistance navigating the marketplace. Last year Kootenai’s social workers assisted over 1,500 individuals.

“We are trained to know the registration process and the plans well,” Pam Thompson, director of Kootenai Health Social Services, said. “We meet with people one-on-one to go over the different plan options, answer questions and help get them enrolled.”

If a person does not qualify, Kootenai’s social workers can help explore other financial programs that might help them meet health care needs. Even if the income requirements are not met, still enroll in the program. This way, the program can check for state Medicaid eligibility or Children’s Health Insurance Program (CHIP) eligibility.

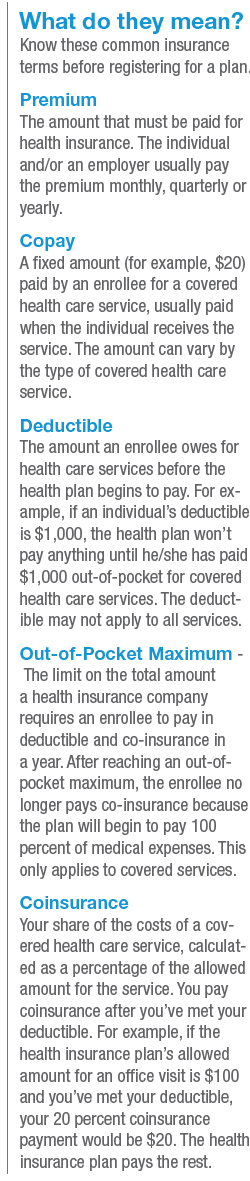

“Many individuals believe that plans on the marketplace have high premiums or high deductibles,” Deanna Brunk, Kootenai Health Social Services, said. “However, each individual and family is different, so each household will receive a plan that is set based on their circumstances.”

Your Health Idaho has four plans, separated into four health plan categories — Bronze, Silver, Gold, or Platinum. The plan category you choose affects the total amount you will likely spend for essential health benefits during the year.

Once a plan is selected, it is important to understand how to use the benefits and plan for any known expenses.

“When considering an elective or scheduled procedure, consider where you are at on your deductible and if you have not met much but it is late in the year, consider postponing until the next plan year to accumulate more dollars toward your deducible and coinsurance,” Mark Woodworth, a consultant at Helbling Benefits Consulting, said. “And likewise, review the list of preventive services covered by your policy. Many annual services, such as mammograms, PSA test and annual exams are covered at 100 percent and don’t require a deductible to be met, even on a Health Savings Account (HAS) plan.”

If you have a planned procedure in the upcoming year, call to get a personalized estimate for the most accurate information about health care costs. Like many health care organizations, Kootenai Health offers cost estimates based on any upcoming services and your health insurance provider, including the specifics of your coverage plan.

Frequently Asked Questions

When is the open enrollment period? Open Enrollment is November 1, 2015 to January 31, 2016. Medicaid, CHIP and Small Business Health Options Program (SHOP) participants may apply at any time.

Can I apply for a plan prior to the enrollment period? There are several circumstances in which an individual or family may apply outside of the enrollment period. These include (but are not limited to) moving from another state, loss of insurance coverage, marriage, or income changes that may affect your eligibility in the program.

I have a pre-existing condition. Can I still qualify for a health insurance plan? Yes, the Affordable Care Act indicates an insurance provider cannot look at pre-existing conditions as a determination for coverage or premium price.

My spouse has health care coverage through their employer; can I still get a plan on the Marketplace using his income? Yes, if you are in the household together and meet the income requirements you can use your spouse’s income to determine eligibility.

If I already have Medicare, will I get a penalty for not enrolling in a health insurance plan on the Marketplace? No, Medicare Part A or Part C and Medicaid are considered minimal essential coverage.

Once I have health care coverage, how can I find a physician? Kootenai Health has an Appointment Center that can help you find a primary care physician. Call (208) 265-6767 or toll free at (844) 627-9411